Starting a New Business Guide The Accountancy Partnership

A review of the applicable dissolution and liquidation options and formalities for ending the legal existence of an incorporated entity. While the discussion focuses on a British Columbia incorporated company substantially similar options exist for federally incorporated entities. Endeavor Law can assist business owners, directors and/or shareholders facing potential winding-up or dissolution.

Dissolving Fears A Conversation with Jana Beeman Joyful Journey (podcast) Listen Notes

To dissolve a company/corporation, at least two-thirds of the shareholders must vote in favour of dissolution, or the board of directors or sole shareholder of the company must decide to do so. In British Columbia, file an Application for Dissolution on the provincial Corporate Online website. The company must be up to date with annual report.

dissolving Word Search WordMint

D. Notification of the Dissolution of Partnership Date of Dissolution: May be a past, present, or future date. If you are dissolving the partnership, please complete sections A, B, C and D only and sign your name in Section H. E. Change in Nature of Business: Provide a brief description of the new nature of business (e.g., corner

Dissolving Matter YouTube

An application for voluntary dissolution can be done quickly and easily if the procedures set out in the Act are followed. The first step is for the shareholders of the company to pass an ordinary resolution requesting the Registrar of Companies to dissolve the company. Another step is obtaining a sworn affidavit from a director of the company.

Dissolving Cartoons, Illustrations & Vector Stock Images 17965 Pictures to download from

To request a delay in the dissolution or cancellation process you will require the incorporation or registration number of the company to proceed. Any person can request a delay of dissolution or cancellation. Your delay request must be submitted prior to the dissolution or cancellation of the company. No fee is required when requesting a delay.

"Dissolving " Poster by tillyworld Redbubble

Updated on 08/16/19. Closing a business in Canada is not difficult, but there are more steps than just informing customers and clients and liquidating remaining stock. You also need to cancel your business name or dissolve your corporation and close the relevant Canada Revenue Agency (CRA) and provincial tax accounts.

6 Legal Tips for Dissolving Your Business Due to COVID19 Business

A dissolved company is a company that was once a validly existing company but has since been struck from the BC Registry (in the case of a BC company) and no longer exists. A dissolution may be voluntary or involuntary. Involuntary dissolution most commonly occurs when the company fails to file their annual reports for two consecutive years.

Dissolving an Insolvent Company with No Assets or Debt

BUSINESS CORPORATIONS ACT, section 316. Telephone: 1 877 526-1526 Mailing Address: PO Box 9431 Stn Prov Govt Courier Address: 200 - 940 Blanshard Street www.bcreg.ca Victoria BC V8W 9V3 Victoria BC V8W 3E6.

Dissolving a company What's involved? Portland

The Act states that: (1) In order to apply for dissolution under this Division, a company must: (a) obtain and deposit in its records office an affidavit that is sworn by a director of the company and that complies with subsection (2), and. (b) file with the registrar an application for dissolution in the form established by the registrar.

How to Dissolve a Company CRO

STEP 1: COMPLETE AN AFFIDAVIT. To dissolve a company, the company must first comply with section 316 of the Business Corporations Act. This section, as well as section 344(2), are included in Appendix A for your reference. The first step will be to complete and deposit in the company's records ofice an afidavit sworn by a director of the company.

dissolving sphere shape. green version Stock Vector Image & Art Alamy

Dissolved company's assets available to judgment creditors. 349 (1) In this section, "dissolved company's assets" means, in respect of a company that has been dissolved, the assets, other than land in British Columbia, that were owned by it before its dissolution, that vested in the government and that were received by the government, and includes

What options do you have when dissolving your company?

Price: $ 995.00 CAD. Dissolve a Corporation. Price: $ 495.00 CAD. Extra-provincial Cancellation / Dissolution. Price: $ 495.00 CAD. Choose appropriate Government queue. Regular Queue: File in 10 Business Days $00. Express Queue: File Next Business Day $99.

Dissolving A Corporation In BC Invicta Law

For limited restoration of a benefit company, contact BC Registries at 1-877-526-1526 or 250-387-7848. Note: If the company was involuntarily dissolved within the last year due to failing to file annual reports, the 21 day waiting period from the BC Gazette Publication and notification of directors (whichever is later) will not apply.

Canadian investment company buys 2.5 million worth of virtual real estate in Decentraland

The dissolution and winding-up of a corporation in British Columbia (BC) is a legal process that marks the end of its existence. There are various reasons why a corporation may choose to dissolve, such as the completion of its objectives, financial difficulties, or changes in the business landscape. Understanding the key aspects of dissolution and. Dissolution and Winding-up of BC.

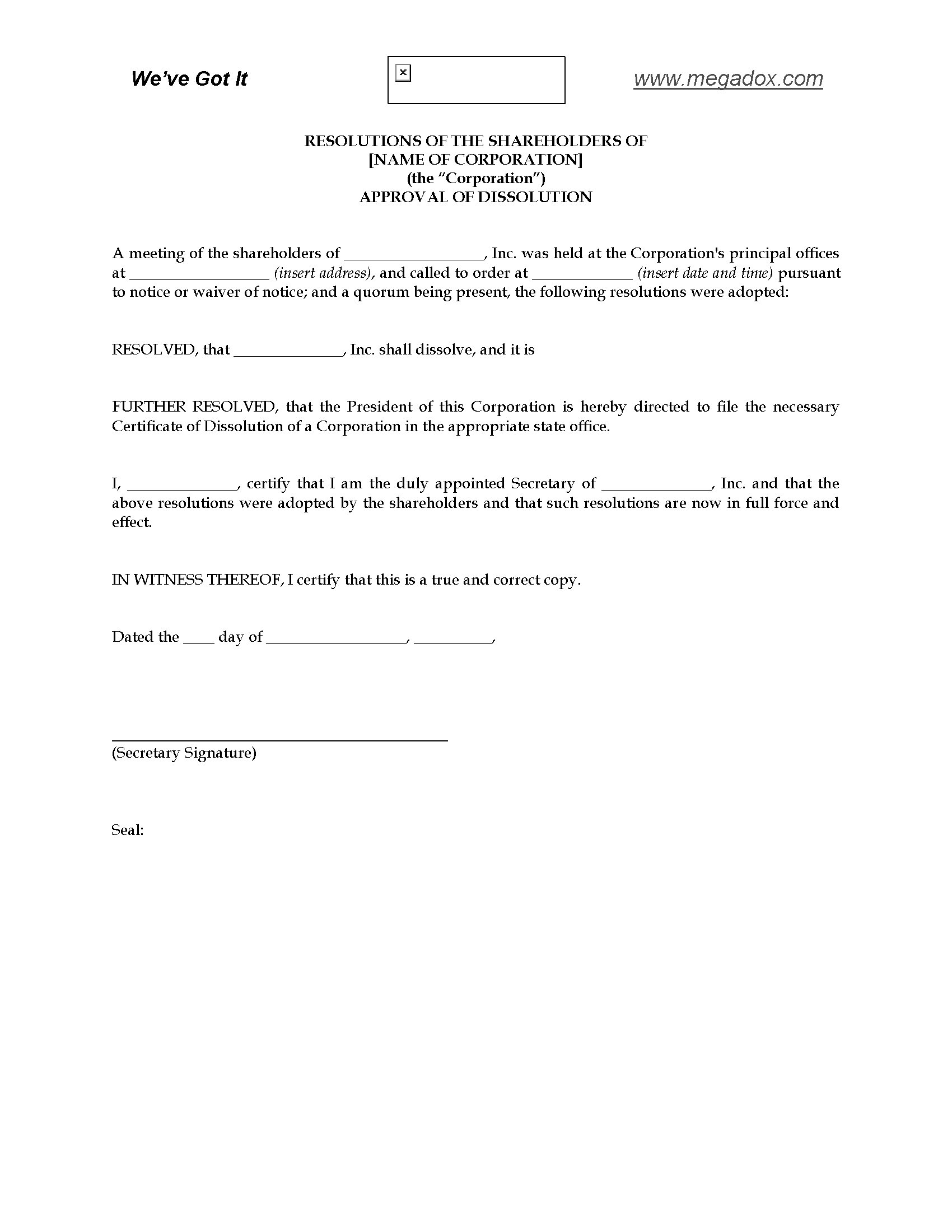

Resolution To Dissolve Corporation Template

Filing an Application for (Voluntary) Dissolution. The following overview provides information on how to file the Application for (Voluntary) Dissolution to voluntarily dissolve a company in BC under section 316 of the Business Corporations Act.. Before you file the Application for (Voluntary) Dissolution, please ensure you read the following information.

The Dissolving YouTube

There are many things to consider when closing your business. Find out your legal requirements. Learn about financial issues. Learn how to dissolve your corporation. Change the legal status of your business. Find out how to close your tax accounts. Learn how to manage your employees. Find out how to dissolve or cancel registration for your: