Current approaches and new approvals in MF and PV YouTube

Pick Your Payment. Choose the payments and lease terms that best fit your budget. No Time in Business Required. We approve the small businesses, start-ups, and weekend warriors the other financing guys deny. Instant Approvals Up to $20,000. As good as cash in hand, not just a pre-qualified amount. No Hard Credit Pull.

Benefits of asset finance Partners Finance & Lease

China is pulling ahead in the burgeoning eVTOL industry thanks to help from regulators' quick approvals, the Financial Times reported. Menu icon A vertical stack of three evenly spaced horizontal.

Finance Leasing Asset Finance Access to Finance

The average credit scores for those who got a lease at the in the first quarter of 2023 were 736, compared to 742 for new car financing and 677 for used car financing, according to the Experian State of the Automotive Finance Market report. When you lease, you're paying for the car's expected depreciation during the lease term, along with a.

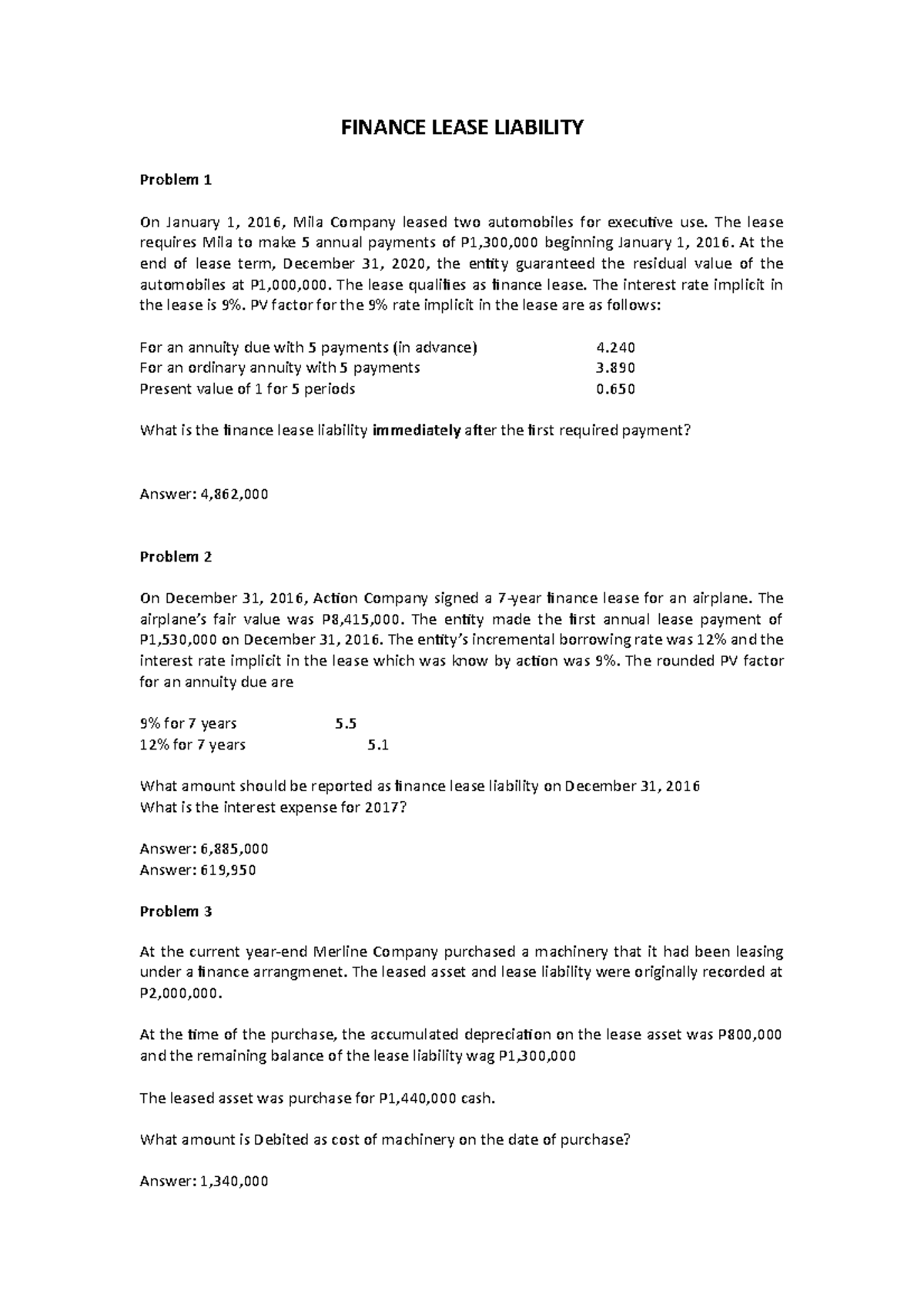

Finance Lease Liability Problem FINANCE LEASE LIABILITY Problem 1 On January 1, 2016, Mila

Auto Approve offers refinancing for several types of vehicles as well as lease buyout loans.These loans range from $10,000 to $150,000 and come with terms from 12 to 120 months. Both loan options.

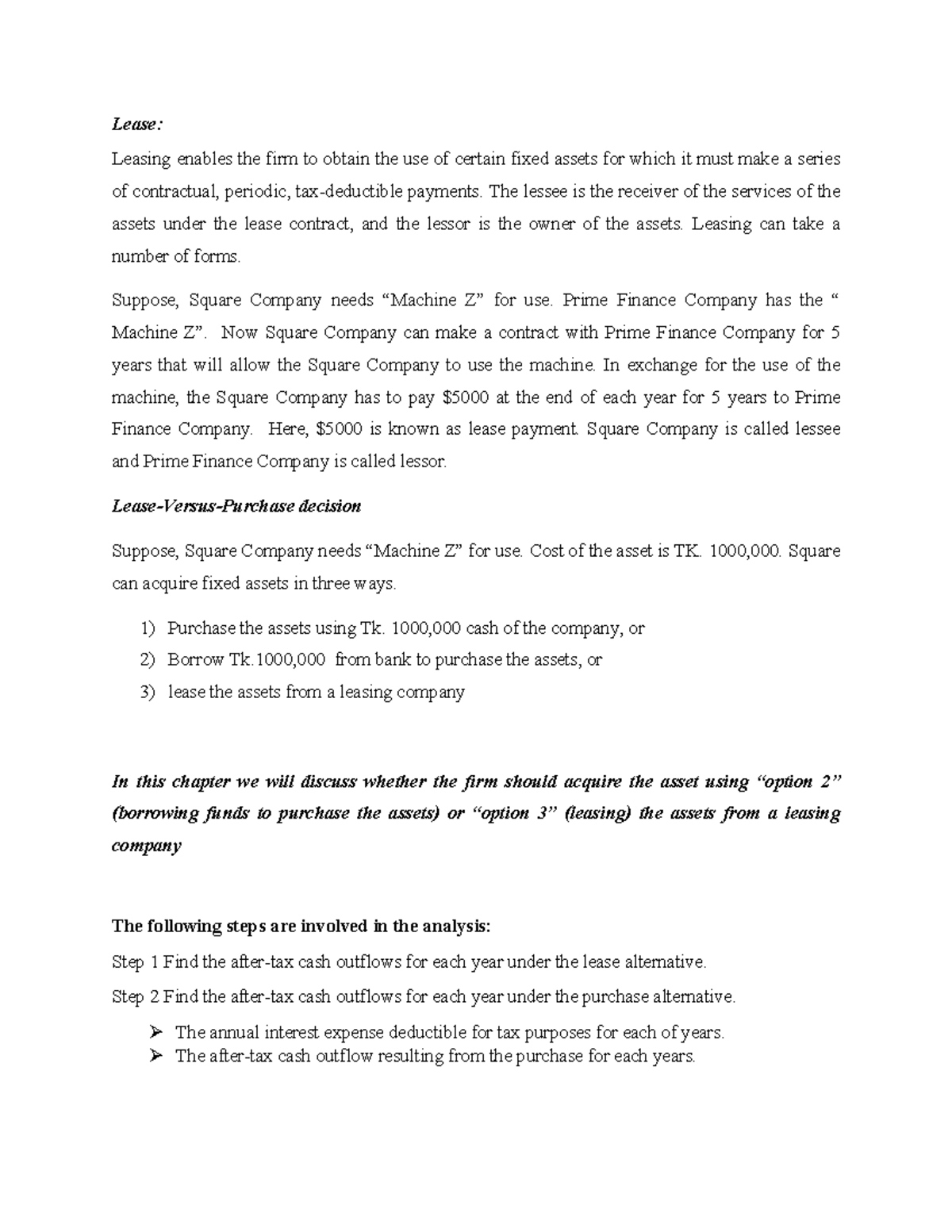

Finance lease Lease Leasing enables the firm to obtain the use of certain fixed assets for

There's more to financing than a simple Click to Lease. Using Credit is not the Key to your next piece of equipment.. Approvals for credit scores as low as 550. QuickSpark. Others.. Quick and simple finance technology integration. X. We Champion Small Business.

Saving approvals as PDFs in Microsoft Teams SharePoint Stuff

Your pre-approval will include: Maximum lease amount. Monthly payment estimate. Total initial cash required. Maximum lease term (in months) End-of-lease purchase option. Other costs or fees. Example: You are pre-approved for a $15,000 equipment lease with no down payment required, an estimated monthly payment of $300, first and last payments.

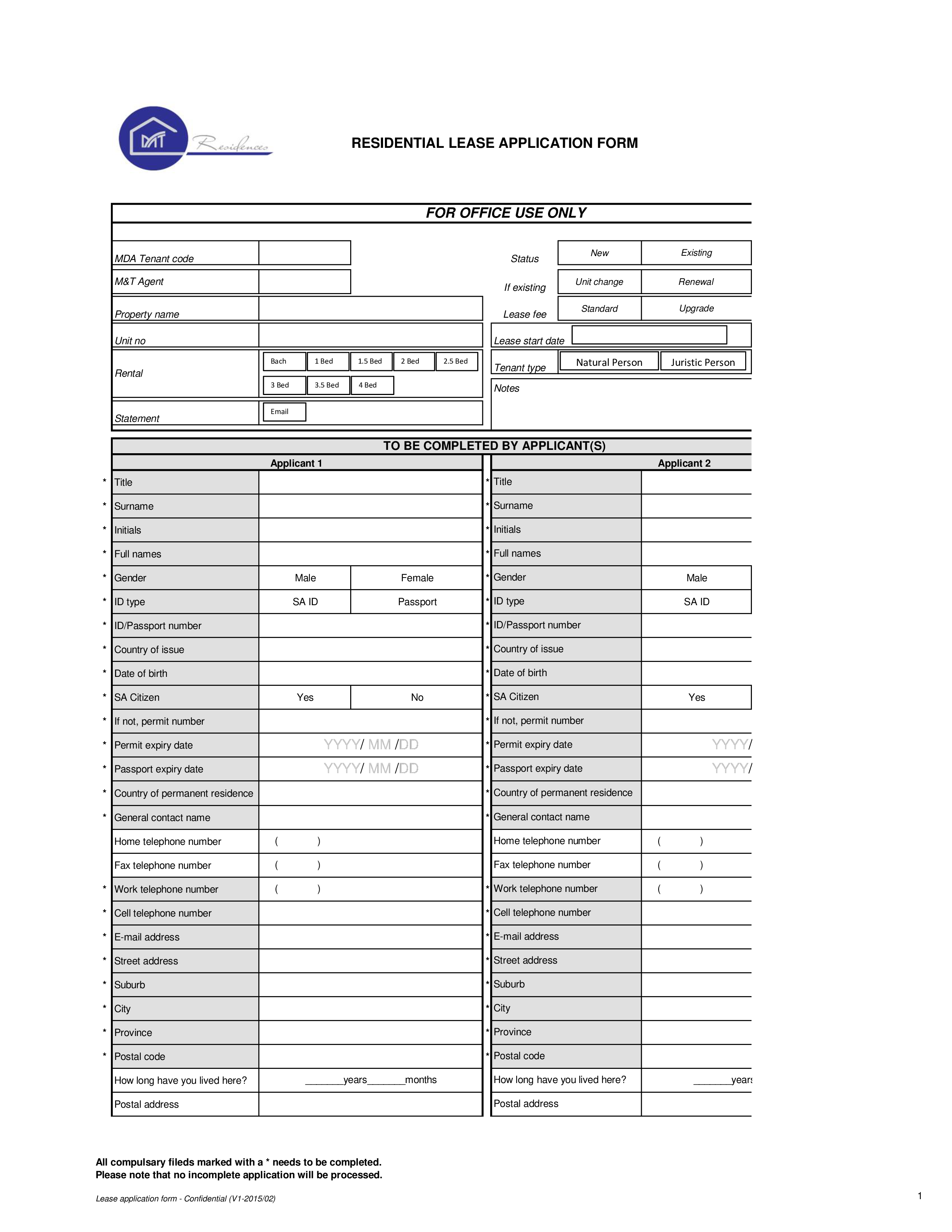

Gratis Generic Residentieel Lease Applicatie

100% financing. Traditional banks only finance up to 80% of the equipment's value if your application for equipment financing is approved. But when you work with Clarify Capital, you can get funding for up to 100% of the capital you need. Any interest expense you incur is tax-deductible for your business, as well.

Microsoft Teams Approvals更新了更多模板和功能系统之家

Time: Crest Capital can give you an answer fast. The bank will make you wait weeks. 100% Financing: The bank usually only finances 80% of the equipment, and no soft costs. Crest Capital will finance 100%, and will also finance soft costs, like delivery, installation, etc. (Lower Upfront Costs) First Born Not Required: The bank will require.

Approvals Turck Inc.

In conclusion, our Electro Finance review shows its ease of access to the latest tech, no matter your credit history. It's a game-changer for those looking for flexible leasing options. Additionally, the review uncovers the practical benefits of choosing Electro Finance, from easy applications to quick pickups.

Reasons To Finance Your Concrete Project Concrete Financing Stabil Solutions Top Rated

2. Apply for Lease-To-Own: The application process only takes a couple of minutes to complete. Don't let bad credit hold you back - for qualified customers with good to low credit we offer approvals up to $4,000 with only a $39 processing fee due today. 3. Take Home What You Need Today: Once you're approved, have signed the lease.

The Approvals tool setup. WorkDo FAQ

Our customers are entrepreneurs with a dream. Clicklease offers equipment financing to small businesses. Get final approval in seconds - All credit scores welcome - Approvals of up to $15,000. Apply now!

(PDF) Study on the Fundamental Default in Ship Finance Lease Contract

Equipment Loans & Leases. Quick Approvals. Common Sense Rates. Easy Financing. At Envision Finance, our strength is providing small and medium-sized businesses with the equipment, vehicle, and unsecured cash financing you need at better rates, while also eliminating the hassle often encountered with typical bank loans.

Goodluck India Limited (Infrastructure & Energy Division) Approvals

Comprehensive: Loan and lease options on new, used and titled equipment Competitive: Up to 100% financing for equipment, competitive rates and flexible terms Convenience: Customized payment plans based on your needs Improve Cash Flow: More affordable monthly payments increase available funds, and payments can be scheduled to coincide with a company's seasonal cash flow

[Solved] On January 1, 2021, DBT Inc. entered into a fiveyear finance lease... Course Hero

Unlike other financing solutions, equipment financing specifically deals with the purchase or lease of business equipment. Since it is a form of asset finance, the equipment is funded over a stipulated period of time in exchange for regular payments. After the completion of the payment period, the business will own the equipment outright.

(PDF) The DecisionMaking for the Optimization of Finance Lease with Facilities’ TwoDimensional

Choose from business checking, small business loans, business credit cards, merchant services or visit our business resource center. Investing by J.P. Morgan Whether you choose to work with a financial advisor and develop a financial strategy or invest online , J.P. Morgan offers investment education , expertise and a range of tools to help you.

How to apply for a quick loan and get fast approvals? News Blogged

Auto Approve has an A+ rating at the Better Business Bureau, as well as a 95% customer satisfaction rating on LendingTree — but if you're in search of a new auto loan for a new or used car rather than a refinancing deal, then it won't be the right option for you.. A closer look at Auto Approve auto loans. In addition to auto refinancing, Auto Approve offers lease-end buyouts, which.